charitable gift annuity administration

Charitable Gift Annuity We offer comprehensive affordable gift annuity administration for your charitable organization freeing you to concentrate on other tasks. After the death of.

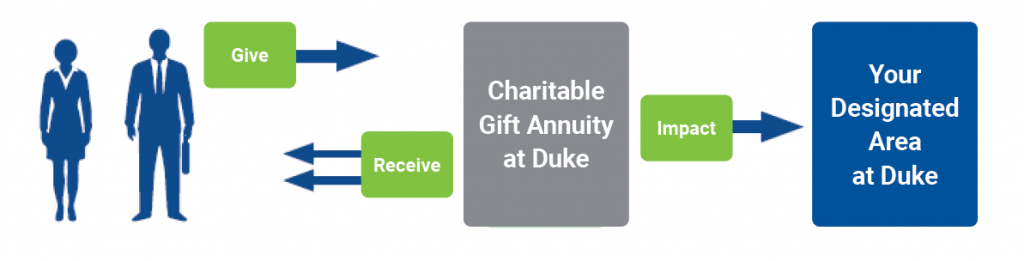

Charitable Gift Annuities Giving To Duke

Previously she was with Charitable Trust Administration Company where she spent over 10 years assisting non-profits with the management and administration of their charitable programs.

. Learn More About Annuities. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. A Charitable Gift Annuity CGA with NCF is a simple arrangement that involves a charitable gift and an annuity.

We offer deferred flexible and immediate gift annuity structures and the. Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals. With gift administration one could extend the expression to include payments compliance reporting and managing exceptions.

125 rows Since 1955 the ACGA has targeted a residuum the amount remaining for the charity at the termination of the annuity of 50 of the original contribution for the gift. The Lord said it is better to give than to receive. We are a one-stop shop for any financial services.

The portion of the annuity purchase that is. Find a Dedicated Financial Advisor Now. Upon death the remainder goes to support the area of.

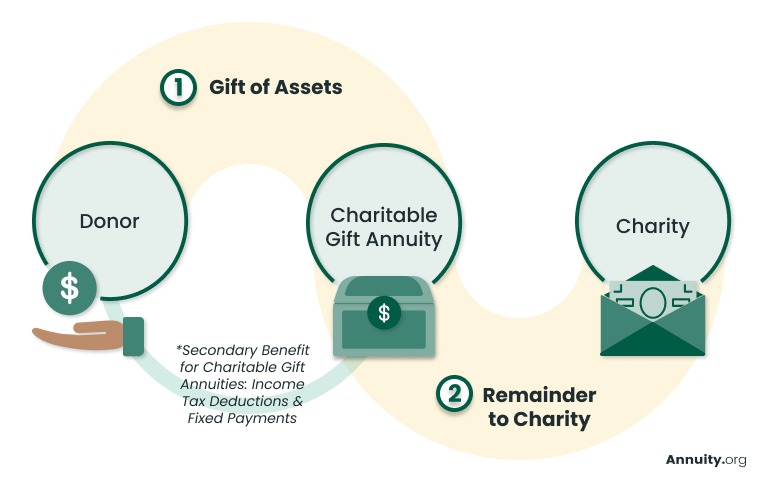

Ad Annuities are often complex retirement investment products. In exchange for a gift of assets ie cash stock bonds real estate etc the. New Look At Your Financial Strategy.

Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now. With a charitable gift annuity you can do both.

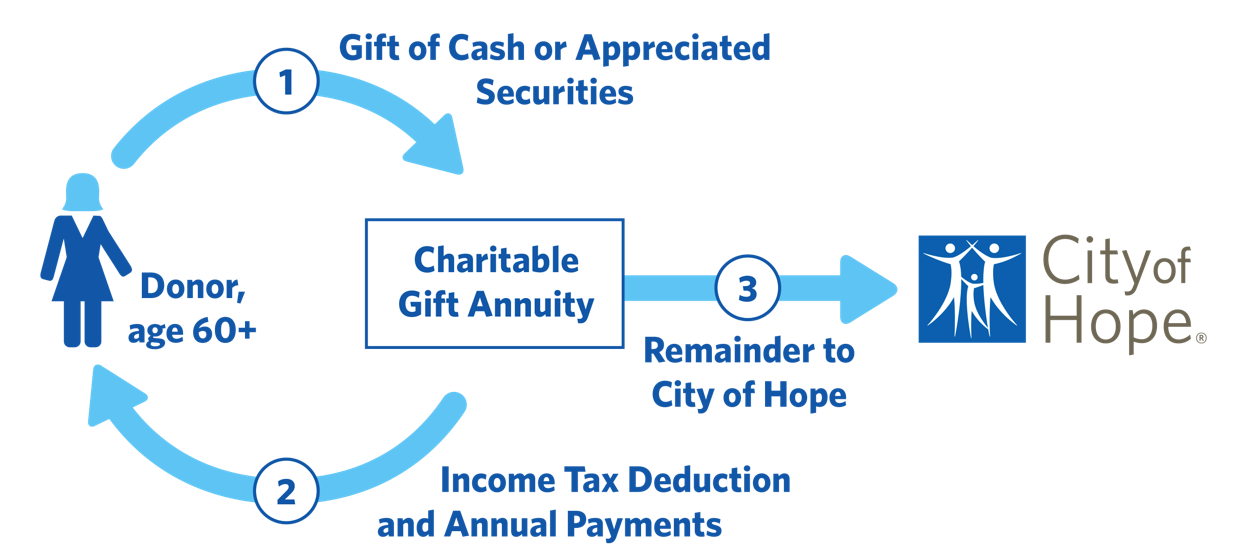

A CGA delivers fixed income for life immediate tax benefits and a. Visit The Official Edward Jones Site. A charitable gift annuity CGA provides a fixed lifetime income payment to you as the donor s or to one or two life income beneficiaries annuitants you may designate.

Fixed Payments Eliminate The Impact Of Market Volatility. We tailor our services to. Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals.

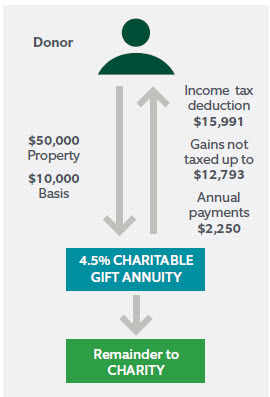

In general the charitable deduction is for the estimated value of the contribution to the charitythe value of the money or property contributed minus the value of the right of the. Ad Read the Other Advantages an Annuity Provides How You Can Benefit from One Today. Recognized by the IRS as a form of philanthropic giving a charitable gift annuity offers a number of potential tax advantages.

A charitable gift annuity is a contract between a charity and a donor that in exchange for an irrevocable transfer of assets to the charity the charity will pay a fixed sum to the donor andor. In exchange for the charitable contribution donors. The platform offers complete donation management tracking and integration.

Charitable Solutions LLC in Jacksonville FL administers and works with the National Gift Annuity Foundation NGAF. The ACGAs new single-life rates are 04 to 05 lower than the rates that went into effect on January 1 2020 and the new two-life rates are 03 to 05 lower. Encourage the benefactor to do everything on the same day such as write the check and mail it on the same day.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. You make the gift part of which is tax deductible and then you. Immediate income tax deduction and a fixed annual payment for your lifetime.

Learn some startling facts. Frank Minton PhD the principal author of the Charitable Gift Annuities. Offering constructive expert administration services to assist you and your donors in managing your philanthropic endeavors.

Again the value of the IRA at the account holders death in included in the donors gross estate per the IRS but the estate may claim a charitable deduction for the portion. The Complete Resource Manual has long been recognized as the countrys leading gift annuity. Do Your Investments Align with Your Goals.

A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization. Ren delivers planned-giving administrative services tailored to meet your needs. Ad Givelify is the most widely-used charitable giving platform for nonprofits.

Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years. Ad Read the Other Advantages an Annuity Provides How You Can Benefit from One Today. Usually regulation is under a states Insurance or.

If the assets for the gift are coming from more than one location make sure. Our recent Webinar on Gift Annuity. Established in 1995 Charitable Trust Administration Company.

Your one-stop shop for charitable gift services. Maintain complete accurate and confidential records. Meridian St Suite 700 PO.

Charities that offer charitable gift annuities should be aware that many states regulate the issuance of gift annuities. A Charitable Gift Annuity is a contract between a donor and National Catholic Community Foundation that provides a lifetime of annuity payments to the donor and survivor or other. Charitable gift annuities allow donors to make tax deductible contributions to a charitable organization.

Receive income for life. Charitable Gift Annunity Administration Establish CGA administrative pools for efficient monitoring and payment management. Your gift to Duke establishes a charitable gift annuity.

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

City Of Hope Planned Giving Annuity

Charitable Gift Annuities University Of Montana Foundation University Of Montana

Charitable Gift Annuity Pros And Cons Blog Jenkins Fenstermaker Pllc

Charitable Gift Annuities Giving To Duke

Change Of Address Checklist Real Estate Seller And Buyer Etsy Change Of Address Checklist Listing Presentation

Charitable Gift Annuities Friends University

Charitable Gift Annuities The Community Foundation For Greater New Haven

6 Benefits Of A Charitable Gift Annuity Giving To Duke

Charitable Gift Annuity Licensing Compliance In Indiana Harbor Compliance

4 Long Term Ways To Give To Charity Capstone Financial Advisors

Cga Program Best Practices You Need To Know A Review Of The Acga Cgp Cga Survey

Charitable Gift Annuities Mayo Clinic

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuities Kqed

Charitable Gift Annuities Uses Selling Regulations

4 Long Term Ways To Give To Charity Capstone Financial Advisors